Luke

Director of Ecommerce: Quality Home

The Buy Now Pay Later Market in the USA

The US BNPL market has seen massive growth over the last few years, projected to reach nearly $100 billion by 2030.

Today, more and more ecommerce customers are choosing BNPL solutions as their preferred payment method.

Here at WeGetFinancing, we offer an innovative BNPL solution proven to convert more traffic and increase sales, ensuring you optimize this payment trend.

Customer Access

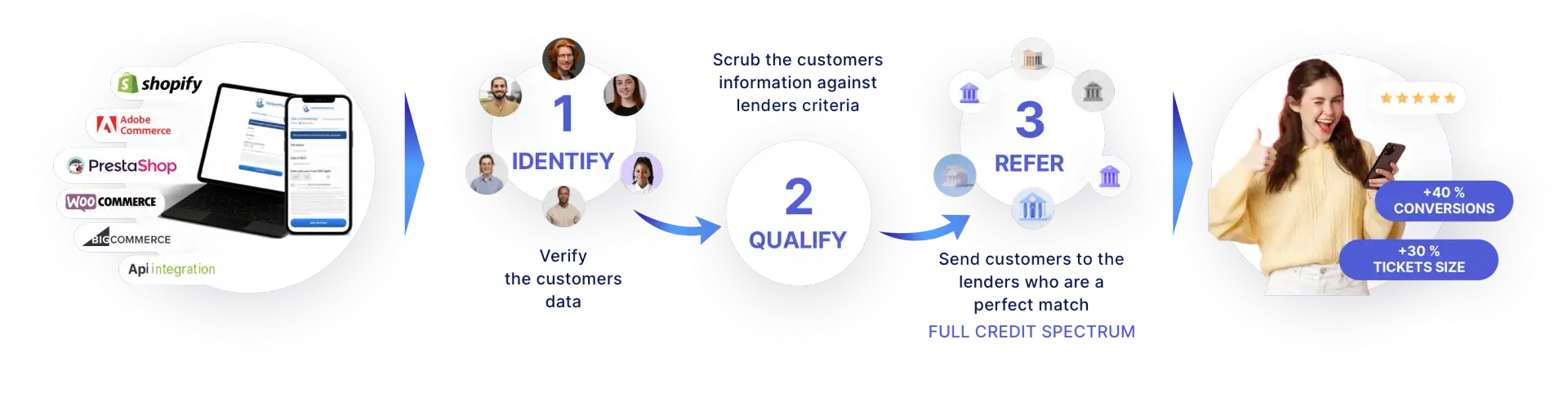

Give your Consumers Access to an Expanding Lender Network with One Application

WeGetFinancing's BNPL Gateway boosts sales with simplified, flexible financing options.

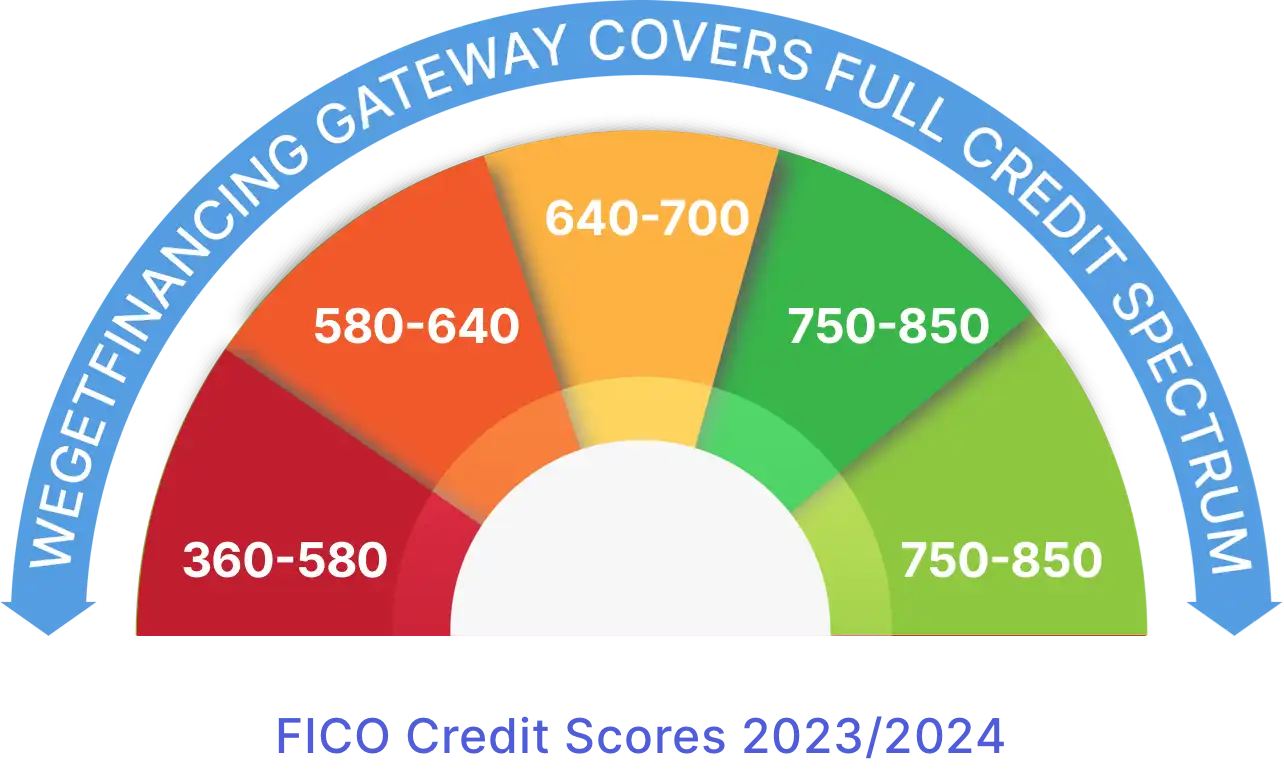

One application, multiple lenders, all credit scores covered.

Breaking barriers in consumer financing

Say goodbye to high rejection rates and hello to increased sales. Our state-of-the art IQR technology only sends your customer to lenders that are a perfect match, allowing them to compare multiple offers, side-by-side, and select the best option for their budget and lifestyle.

FULL CREDIT SPECTRUM & MORE INCLUSIVE FINANCING PLANS

We value your customers time, which is why we have developed a frictionless, end-to-end process. No need to submit multiple financing applications.

Our single application will lead consumers to what they value most-OPTIONS.

Your customer will only be presented with offers for which they have already been approved.

Our innovative technology gives us insight into your demographics, allowing us to create a custom-suite of lenders designed for your traffic.

Guaranteed Customer Satisfaction

Guaranteed Customer Satisfaction: A Frictionless Checkout Experience

Unlock the freedom of instantaneous credit! Our BNPL Gateway gives your customers instant access to an expanding lender network & tailor-made financing options across the full credit spectrum.

Streamline Checkouts & Increase Customer Lifetime Value: Our single point of entry application ensures quick & easy approvals for all credit types. Customers can now experience a frictionless end-to-end checkout.

Tools & Widgets to Improve Your Customer’s Journey: Our purchase power estimator widget allows your customers to select their credit range right on the product page, giving them a real-time estimated payment & a better understanding of their ability to pay.

Business model

Your success is our success

No subscription fees. No integration fees. No set-up fees. Get started without the hassle.

WeGetFinancing’s Gateway is a performance-based model. We only make money when you do.

SEAMLESS INTEGRATION. WeGetFinancing.

Easy start no hassle.

WeGetFinancing offer a seamless, plug & play integration with all ecommerce platforms. Easy start, no hassle: from technology to paper work, our simplified registration process will grant you fast activation with our expanding lender network.

WHAT OUR PARTNERS & MERCHANTS SAYABOUT US

Merchants FAQ

Who is WeGetFinancing?

What does it mean to be full credit spectrum?

What e-commerce platforms does WeGetFinancing offer a solution for?

Is WeGetFinancing’s BNPL solution available for any industry?

I already offer financing. Why should I use WeGetFinancing?

How is this different than waterfall lending?

Isn’t that just like Affirm or Klarna?

Can I offer promotional programs with WeGetFinancing?

What are the Terms & Conditions that apply to WeGetFinancing merchants?

How do I partner with WeGetFinancing?

Is WeGetFinancing for online merchants only?

How can I utilize WeGetFinancing for my brick and mortar store or call center?

How can I utilize WeGetFinancing for my e-commerce business? Is it compatible with other payment systems?

Can WeGetFinancing process an application through a mobile device?

What are the minimum and maximum purchase amounts for a customer to qualify?

What information will my customer need to provide to submit a WeGetFinancing application?

Can WeGetFinancing approve all my customers for credit?

Does WeGetFinancing charge any fees?

How can I monitor my transactions?

How can I contact the WeGetFinancing Merchant Support team?